Under the extreme pressure, where is the air purifier market going?

In the first half of 2019, the domestic air purifier market continued its weak trend in 2018. The market participation heat is gradually cooling, and the monitoring data from Zhongyikang is also reflected. In 2019, there were 392 air purifier brands on the market. Compared with nearly 500 brands in 2018, the number of brands has decreased by about 20%. Of these brands, 3/4 are invested in the online market and 1/4 are participating in the offline market.

Due to the weakening of the market demand side at this stage, the two-line market is in a contraction situation. Relatively speaking, the offline market performance is slightly better than the online market. This situation is rare in recent years. The past online market has always been an important driving force for the development of the overall empty net market, and the overall market direction has changed. In the case of online market, reactions are more sensitive. Although the online market sales in the first half of 2019 showed a 30% decline, the sales volume was still significantly higher than the offline market. The online market contributed 62% of sales, while the sales contribution was about 20% lower. It shows that the online market is dominated by the volume, while the offline market products pay more attention to quality, and the higher unit price is still continuing.

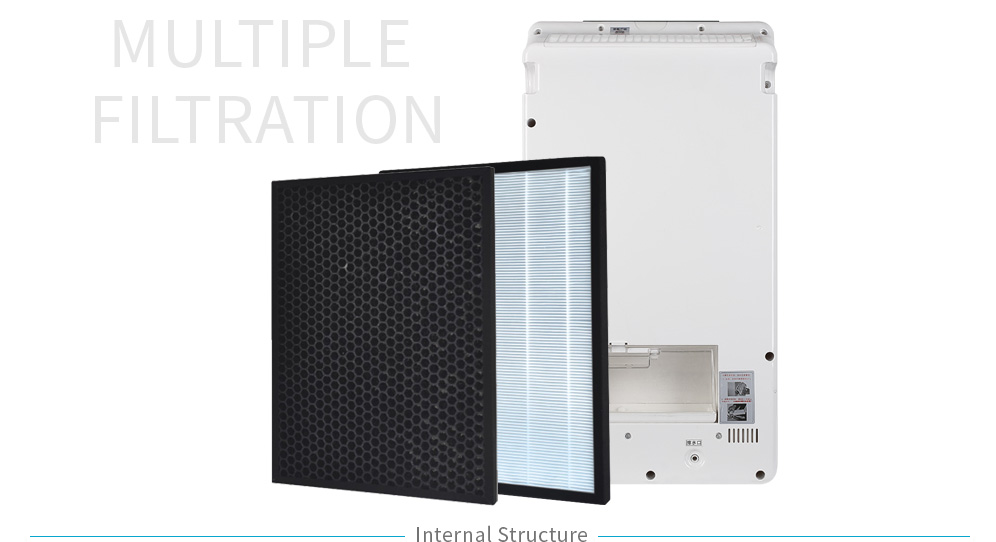

From the perspective of market participants, foreign brands are constantly adapting to the competitive pressures of the domestic market, and it is inevitable. Take the online market as an example. In the first half of 2019, 91 foreign brands were sold, accounting for 1/4 of the number of brands sold. Overall, foreign brands feel less competitive pressure than domestic brands, 91 foreign brands have gained about 47% market share, and 278 domestic brands have a market share of 53%. One reason for this result is that the degree of homogenization of domestic brand products is more serious. Domestic brands are indeed stronger than foreign brands in terms of “big dry”, but this is also a double-edged sword, due to the technical capacity reserve. Insufficient, the proportion of domestic brands using activated carbon and HEPA filters is 20% and 30% higher than that of foreign brands respectively. The technical homogenization combined with the lack of innovative design has affected the brand recognition. Foreign brands are diversified in the choice of purification technology, using a higher proportion of ion technology (high-voltage static electricity, nano-water ions, etc.), in addition to a small number of washing, ozone, ultraviolet, and other purification and sterilization technology.

Technically, domestic brands have no overall advantage, but they have not hindered access to market cakes. Domestic brands outperform foreign brands in product intelligence performance. APP remote control models have a penetration rate of more than 70%, far higher than foreign brands. The product control is convenient for the domestic brand purifier to occupy a clear advantage, and in turn to obtain a better product experience for consumers. It can be said that the two camps have their own advantages, and they are also learning from each other and learning, which has greatly improved the functionality and cost performance of the products.

Convenient handling is indeed attractive to the family of the best household air purifiers, but it is only convenient to operate, but not enough to reverse the current market development trajectory. Failure to achieve significant breakthroughs in products is a major obstacle to the iterative upgrade of the air-net industry. Although in the past year, in addition to the net consumption of formaldehyde in the market, some consumers have paid attention to it, it has not been able to effectively activate the consumer demand side. Compared with the internal driving force of panic buying due to the fog and the city, the gap is huge.

The Olansi room air purifier needs to be repositioned, which will be crucial for the future development of the empty net market. There are two kinds of trends in the market that are worthy of attention: First, cross-border winds, “warm air + purification”, “humidification + purification”, “dehumidification + purification” environmental electrical appliances emerge one after another, their emergence is breaking the consumer’s inherent environmental home The cognition of the single function of electrical appliances; the second is the deepening of the purification function, from the removal of gaseous pollutants such as mites and formaldehyde, to the comprehensive consideration of odor, allergens, and mites. Behind these features is the result of the refinement of the consumer home product application scenario, which needs to be implemented based on the technical capabilities of the enterprise. Therefore, the cultivation of internal work of products is an effective means to break the solidification of the industry. The market is in the adjustment period, which provides a favorable market environment for the prepared enterprises. When the tide recedes, it is known who is in the nude swimming, and the empty net industry needs to conduct a necessary examination of its own development. Only when the market has undergone an adjustment period will face more opportunities in the future market development opportunities.

Contact us for more products and discounted prices

Helen:

+86 13922346046

info@olansiglobal.com

https://www.olansiglobal.com